Contenidos

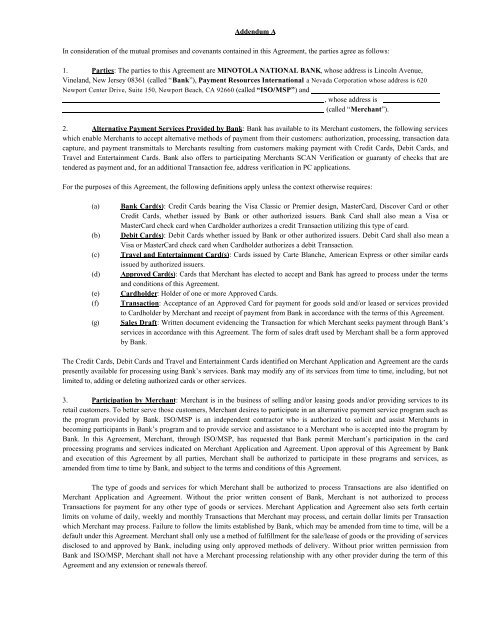

Of a lot or most of the businesses seemed offer compensation in order to LendEDU. Such commissions are how exactly we look after the free provider for consumerspensation, along with days regarding inside-depth article search, decides where & how people appear on our very own webpages.

If you are searching to own a way to find some extra dollars to settle personal credit card debt, post young kids to college, take an enormous travel, or renovate local payday loans Stonegate CO your home, you have most likely found the second financial otherwise household guarantee financing given that a choice.

An effective 2nd home loan try a generic term that is used to describe a loan removed with a home helping because security possessions in that financial doesn’t always have the key state they the equity in the eventuality of a standard.

Meanwhile, property equity financing lets this new homeowner to borrow on this new guarantee in the home. In most factors, another mortgage and you may house security mortgage are identical topic.

Second Financial and you may Domestic Collateral Loan Distinctions

Most of the time, a property guarantee financing is simply a specific sort of second mortgage. You will find that instance you to serves as an exception to this rule, and that we’ll coverage less than. However, very first, property collateral loan lets a citizen borrow on the latest equity in the home. The amount this new citizen can also be obtain will depend on the difference involving the newest worth of our home and the overall an excellent home loan obligations.

A home loan include a term that says the lender must be the key lien holder against the property. Therefore, another obligations with the exact same assets just like the security need to feel second to your financial. After you pay-off your mortgage, however, the lender releases brand new lien up against the property without prolonged has a claim to the newest equity.

You could, but not, borrow cash having a property guarantee loan even although you zero extended keeps a home loan. In such a case, youre borrowing against the completely equity stake about home. Our home security mortgage may be the earliest lien against the possessions since it shouldn’t have to be second to the most other financial lien. When you have 100 % equity of your house, our home security mortgage is not an additional mortgage.

Second Home loan and you will a house Guarantee Loan Similarities

By taking away a property collateral mortgage when you already has outstanding financial debt, your house guarantee financing gets categorized since the a second mortgage. Our home security mortgage lender has actually a holiday claim to the fresh new security possessions in case there are standard.

In the event that a debtor non-payments with the both the borrowed funds otherwise household collateral financing, the lender will start foreclosures proceedings. The key lending company comes with the earliest claim to the newest continues from property foreclosure, therefore the second lien manager possess a state they whatever was left over.

The house security loan otherwise next mortgage keeps a slightly large interest as compared to rate of interest on the an initial mortgage. The pace is actually higher since the lender’s claim to the newest property is considered riskier than just compared to the loan financial having a primary state they the latest security possessions. Household guarantee finance usually have a predetermined interest and a good 10 to 15-12 months term.

House Collateral Mortgage & Second Home loan Spends and you will Threats

Apart from the fresh relatively lowest borrowing from the bank pricing, one of the greatest advantages of a house equity mortgage are their liberty. Borrowers can use this new proceeds from the loan your individual fool around with they require. There are not any limitations about how this new borrower are able to use the bucks. Consumers may use your house security financing to help you consolidate or pay away from high-desire credit debt, take a family group vacation, pick an investment property, post their children to college, or renovate their property.

Although the notice towards the household collateral loans was previously deductible toward borrower’s government taxation return, the law changed from inside the 2018. The eye borrowers spend to their domestic guarantee financing is only deductible on their government taxes if they use the proceeds so you can create a critical recovery or update with the underlying a property.

Risks

The biggest exposure by using the second financial otherwise home security financing ‘s the chance to your home. Borrowers can availability large volumes of money on good relatively low interest rate when comparing to handmade cards or individual money. This really is simply you’ll be able to as borrower’s household functions as equity to secure the financing.

In case the borrower later on face monetaray hardship and cannot make the monthly premiums towards household equity financing otherwise next home loan, the financial institution will foreclose to your root collateral property manageable to fulfill the brand new borrower’s personal debt obligations. As the borrowers could easily reduce their homes because of standard, they need to seriously consider the risks from the financing and you can some other selection before taking out another home loan otherwise household guarantee loan.