Contenidos

Leasing is much less when it comes to upfront will set you back. Constantly you have to pay a safety deposit, first month’s and you may history month’s book. Which have to acquire a home, you must built extreme advance payment in order to be eligible for home financing more often than not. There are other costs too when buying a home such because the mortgage setup costs, assets checks, escrow or title business charges, homeowner’s insurance rates or other will set you back which are often tacked to your. You have to determine whether its worth the capital throughout the years.

Price-to-Lease and you will Obligations-to-Earnings

Speaking of two words to remember whenever choosing if property is a good pick or perhaps not. One another rate-to-lease and obligations-to-money ratios concern price vs. money and lease versus. purchase price. Price-to-lease evaluates home loan dominant and you can focus, property taxation, insurance rates, closing costs, HOA fees if the appropriate and home loan insurance rates in the event that relevant. While doing so, tax experts, lease money and you may renter’s insurance are also thought to be the entire price of renting.

Price-to-Lease

To utilize the price-to-book proportion, you need to have the typical record speed to your average annual lease having belongings in this town. Then you definitely calculate the purchase price-to-rent ratio by the dividing the common checklist rates of the average yearly book rate otherwise the following:

- Average Record Speed / (Average Monthly Book x 12) = Price-to-Book Proportion; or

- $160,100 / ($step 1,050 x several) = twelve.6

Any time you score an expense-to-rent count that’s below fifteen, you can purchase. In the example more than, this is certainly property that would be really worth buying. At any time its more 15, it’s a good idea to rent.

Debt-to-Income

Another ratio to keep in mind was loans-to-earnings. Which measures the total homes cost-plus other loans against your own money to decide whenever you can indeed pay for a property. Additionally, it is used by particular leasing professionals understand for folks who are able to afford brand new month-to-month will set www.elitecashadvance.com/installment-loans-or/dallas you back. So you can calculate this matter, you separate obligations by money to find a percentage. While this will not check advanced, it depends precisely how much debt and you will income you have.

Financial obligation discusses monthly housing and you will non-property loans costs, that has mortgage repayments, possessions taxation, home insurance, financial insurance coverage, student education loans, auto loans, playing cards, boy service or any other factors. Whilst not most of these might be present on your borrowing statement, it is essential to can compute this commission for the real estate aim. Loan providers tend to be a lot more restrictive from the percentages that they explore to determine what attract and you may dominating you be eligible for–if at all.

A family wants to get a small household into the Hillcrest to own $five hundred,one hundred thousand which have extreme downpayment out of twenty five% ($125,000) to obtain an effective $375,one hundred thousand loan.

Estimate Personal debt-to-Money Proportion

- Full monthly homes will cost you: $2,415 ($step 1,736 financial, $a hundred insurance rates, $579 fees)

- Overall non-homes financial obligation: $a hundred (charge card)

- Month-to-month income: $nine,100

- Debt-to-earnings proportion = ($dos,415 + $100) / $9,000 = 27.9%

This is a good updates to settle for choosing it house. The fresh ratio is pretty lowest that they may pay the domestic.

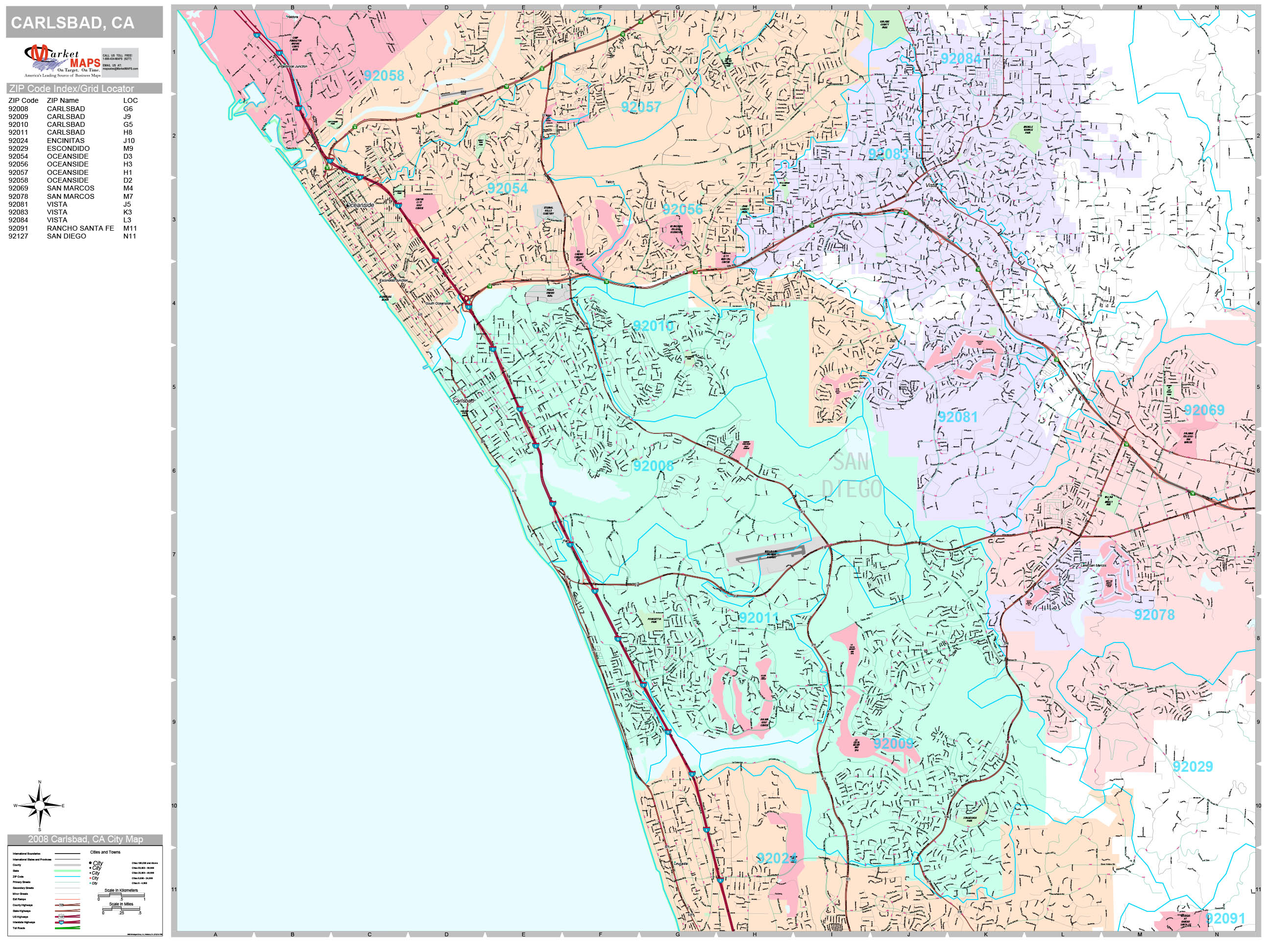

You can just lookup the newest lease values to your area to choose whether it’s worth it purchasing or rent a home. With the above example of the brand new Hillcrest household, discover components of Hillcrest where in actuality the lease is just as reasonable once the $step one,100 1 month getting one home and as high since the $15,100000 four weeks.

One more thing to believe are homes income tax deductions. A house are less when you calculate this new annual financial appeal and you will possessions income tax paid down by an average income tax class regarding 30 percent. You’ll receive this new annual taxation deals, which you’ll next split by 12 and you may subtract out of month-to-month property can cost you to see if it’s lower than monthly book.