Contenidos

The fresh new longer the mortgage term, the greater number of interest you can easily shell out ahead of zeroing your harmony. When you are selecting the low you’ll be able to borrowing rates, a shorter-identity mortgage is often better.

Identity size is going to be a function of loan dimensions as well. When you’re trying to get an excellent $5,100000 mortgage, their restriction label size is 3 years. https://clickcashadvance.com/installment-loans-ak/central/ Into the a good $50,one hundred thousand mortgage, it would be 84 weeks otherwise prolonged.

Nevertheless, we love loan providers offering a variety of loan words, as well as that- so you can a couple of-seasons terms for all of us credit reduced.

Rates

Surprisingly, consumer loan rates of interest are erratic. Centered on their unique, less-than-transparent underwriting protocols, several lenders you will provide completely different rates into same debtor. That is down seriously to just how high-risk the fresh lender’s underwriting design believes the fresh new debtor was – an evaluation that’s not constantly totally purpose.

All of that said, some lenders are recognized for giving very low rates to help you better-qualified individuals (less than 6% APR), or for with lower restriction interest rates (below 20% APR). We make use of this article towards the all of our reviews wherever possible but do not provide it with too much lbs.

In which Is it possible you Rating a personal loan?

Banking institutions, borrowing from the bank unions, and online loan providers most of the undertake apps private financing. As the stone-and-mortar banks and you can credit unions tend to have strict underwriting standards getting unsecured unsecured loans, the past option could possibly offer a knowledgeable threat of achievement.

You simply cannot get wrong deciding on the loan providers into the it list. It is possible to use that loan broker such as for example Fiona to look rates and you will conditions off numerous lenders at once, score prequalified of loan providers which are often a good fit to have you, and choose an informed mortgage promote to meet your needs.

So what can Make use of a consumer loan To possess?

- Combining credit debt or any other sort of highest-appeal loans

- Significant sales, such as for instance a personal-class automobile purchase

- Home improvement plans

- Settling scientific expenses

- Level marriage or any other special day expenditures

- Layer costs regarding another type of otherwise then followed infant

- Level swinging expenditures

- Protecting company financing

Expect you’ll be required to identify that loan mission when you pertain, but remember that loan providers are unable to control everything create along with your unsecured loan’s dominating.

Having said that, not every unsecured loan play with is wise. Including, discretionary expenditures such holidays plus wedding parties are best paid out away from savings. Combining federal education loan loans might have unintended outcomes, instance death of qualifications for financing forgiveness programs.

What’s Prequalification getting a personal loan?

Prequalification is the lender’s initial breakdown of your creditworthiness, earnings, and other things to be considered during underwriting. It’s the first step toward delivering a consumer loan.

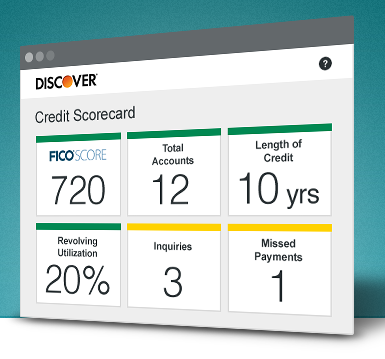

So you can initiate the newest prequalification procedure, you should bring first personal and you can monetary suggestions such as your name, address, annual money, houses payment, and net value. Generally, loan providers manage what is actually labeled as a silky credit remove to evaluate your own credit through the prequalification. A delicate pull will not apply at your credit score.

Merely after you have prequalified getting an unsecured loan do you ever start the true software procedure. Once you apply, you’ll need to support any prices given during the prequalification that have paperwork such as for instance bank account statements and you can shell out stubs. Most of the time, you’ll also must commit to a painful borrowing from the bank remove (credit query), that will temporarily decrease your credit rating.

Just how Hard Could it be to Qualify for a personal loan?

Everything else becoming equivalent, it is much easier to qualify for a personal loan after you keeps sophisticated borrowing, highest income, small expenditures, and you may low levels out of existing loans. But don’t be concerned otherwise meet those people requirements. Of several loan providers enjoys relaxed otherwise nontraditional certification patterns you to think noncredit and you will nonfinancial items such as for example instructional attainment, functions record, also realm of research.